In business, financial projections are essential tools that help entrepreneurs plan for the future. Simply put, a financial projection is an estimate of a company’s future financial performance based on historical data, market analysis, and specific business strategies. These projections are crucial for effective business planning and decision-making, providing insights into expected revenues, expenses, and cash flow.

Getting to know financial projections allows business owners to make informed choices, allocate resources wisely, and set realistic goals. It’s important to note that financial projections differ from financial forecasts, which are more focused on short-term predictions based on existing trends.

While forecasts often rely heavily on historical data, projections incorporate various assumptions about future market conditions and business strategies.

Table of Contents

What is a Financial Projection?

What is a Financial Projection?

A financial projection is like a crystal ball for your business—it helps you see where you might end up financially in the future. In simple terms, it’s an estimate of your company’s future financial performance based on things like your past sales, current market trends, and your plans for growth. Think of it as a roadmap that shows the direction your business could take in terms of revenue, expenses, and cash flow.

Now, you might wonder how projections are different from forecasts and budgets. Great question! While a financial forecast focuses on predicting what is likely to happen in the near term based on current data, a financial projection is broader and more flexible. It takes into account different scenarios and possibilities—essentially, what could happen if you make certain decisions.

On the other hand, a budget is a plan that outlines what you want to achieve financially. It’s more of a target, while projections help you understand the possible paths to reach those targets.

In terms of business strategy, financial projections are super important. They help you set realistic goals and make informed decisions about where to invest your time and resources.

The Importance of Financial Projections

The Importance of Financial Projections

Financial projections are more than just numbers on a spreadsheet—they’re a vital part of running a successful business. Let’s break down why they’re so important:

1. Risk Management

When you create financial projections, you can identify potential risks before they become major problems. By analyzing different scenarios, like an economic downturn or changes in consumer behavior, you can prepare for the unexpected. This means you’ll have a plan in place, which helps you navigate challenges more smoothly and keeps your business afloat even when times get tough.

2. Strategic Planning and Decision-Making

Financial projections are essential for strategic planning. They provide a roadmap for your business and help you make informed decisions. Whether you’re considering launching a new product or entering a new market, having projections gives you a clear picture of how those moves could impact your finances. This way, you can weigh your options and choose the path that aligns best with your goals.

3. Securing Funding and Investments

If you’re looking to attract investors or secure a loan, solid financial projections are crucial. Lenders and investors want to see that you have a well-thought-out plan for future growth. You demonstrate that you understand your business and its financial landscape by presenting accurate and realistic projections. This can significantly increase your chances of getting the funding you need to expand and thrive.

4. Setting Realistic Financial Goals

Finally, financial projections help you set realistic financial goals. By analyzing your past performance and current market conditions, you can create achievable targets for revenue and expenses. This makes it easier to stay on track and measure your progress over time. Plus, when your goals are based on solid data, you’re more likely to reach them and celebrate your successes!

Do You Have a Destination In Mind

Launchroad can help you find the perfect country for your startup. Schedule a free demo today.

Key Components of a Financial Projection

Key Components of a Financial Projection

When diving into financial projections, knowing the key components that make up a solid plan is important. Here’s what you need to focus on:

1. Revenue Projections

First up are revenue projections. This is all about estimating how much money you expect to bring in over a specific period, like the next year. To get this right, you’ll want to consider your sales trends, any upcoming products or services, and market conditions. The more accurate your revenue projections, the better you’ll be at planning for growth!

2. Expense Estimates

Next, we have expense estimates. This is where you list out all the costs associated with running your business. Think about everything from rent and utilities to salaries and marketing. It’s crucial to be as detailed as possible here because underestimating expenses can really throw off your entire plan.

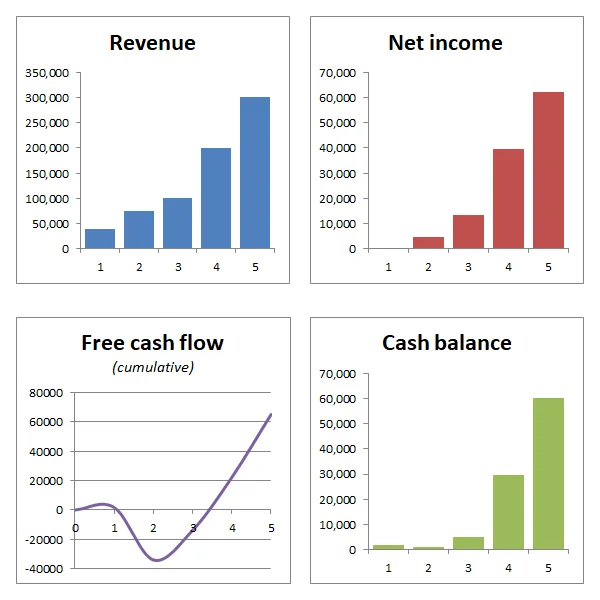

3. Cash Flow Forecasts

This component looks at the money coming in and going out each month. It helps you understand if you’ll have enough cash on hand to cover your expenses, especially during slow months. A good cash flow forecast ensures you won’t be caught off guard when bills come due.

4. Capital Expenditures

Finally, let’s talk about capital expenditures (or CapEx). This refers to the money you’ll spend on big-ticket items like equipment, real estate, or technology upgrades. Knowing what you plan to invest in helps you see the bigger picture and make sure you have enough funds set aside for these necessary purchases.

Importance of Accurate Data and Realistic Assumptions

The success of your financial projections heavily relies on using accurate data and making realistic assumptions. If your numbers are based on outdated information or overly optimistic expectations, your projections won’t be worth much. Always aim to gather data from reliable sources and check your assumptions against market trends and historical performance. This way, you can create a financial projection that’s not just hopeful but grounded in reality.

Steps to Create Financial Projections

Steps to Create Financial Projections

Creating financial projections might seem a bit overwhelming, but breaking it down into simple steps can make it easier. Here’s a straightforward guide to help you get started!

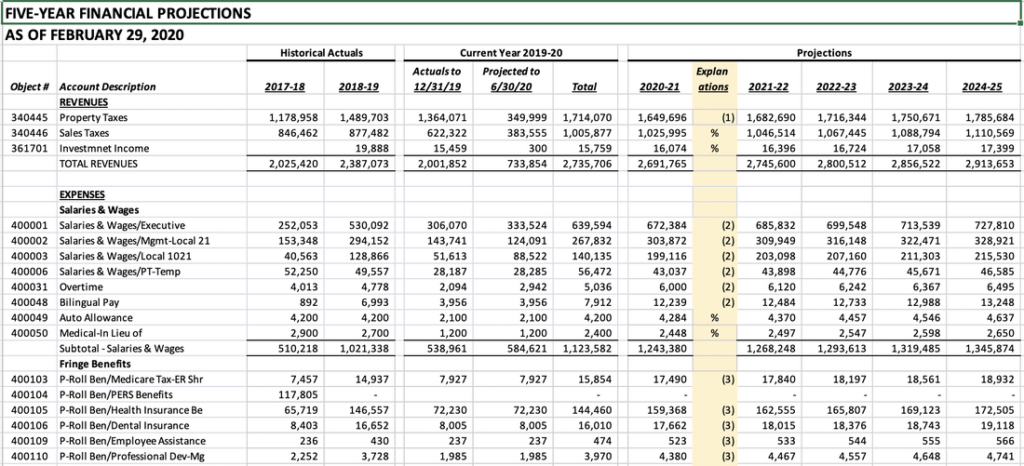

Step 1: Gather Historical Data

The first step is to gather historical data. This means looking at your past financial performance to get a clear picture of where you’ve been. Historical data helps you identify trends, like your typical sales during different seasons or how much you usually spend on marketing. This information is crucial because it provides a solid foundation for your projections.

Step 2: Identify Key Assumptions

Next, you’ll want to identify key assumptions. This step involves thinking about various factors that could impact your business. Consider things like market trends, economic conditions, and your own business strategies. Are there any changes in consumer behavior? Is there new competition on the horizon? These assumptions will help shape your projections and make them more realistic.

Step 3: Choose a Projection Method

Now, it’s time to choose a projection method. There are several different approaches you can take, including:

- Linear growth, where you expect steady growth over time.

- Exponential growth, where you anticipate faster growth as your business scales.

- Scenario analysis, where you create different projections based on varying conditions (best case, worst case, etc.).Pick a method that fits your business model and helps you visualize your financial future effectively.

Step 4: Create the Projection

Once you’ve got your data and assumptions, it’s time to create the projection. You can build a model using spreadsheets or specialized financial software. Input your revenue and expense estimates, and don’t forget to include those cash flow forecasts. This step is where all your hard work comes together, so take your time and make sure everything adds up!

Step 5: Review and Revise

The final step is to review and revise your projections regularly. Your initial projections are just a starting point; it’s essential to keep them updated as new data comes in. If your business landscape changes or you notice unexpected trends, adjust your projections accordingly. Regular reviews ensure that your projections remain relevant and help you stay on track with your business goals.

📌 Must Read: How to Write a CV or Resume as a Startup Founder 👈

Do You Have a Destination In Mind

Launchroad can help you find the perfect country for your startup. Schedule a free demo today.

Different Types of Financial Projections

Different Types of Financial Projections

When it comes to financial projections, there are a few different types you can use, each serving its own purpose.

1. Short-Term vs. Long-Term Projections

- Short-term projections usually cover a time frame of up to one year. They help you plan for immediate needs, like monthly expenses, sales goals, and cash flow. Think of it as your game plan for the next few months!

- On the other hand, long-term projections look at a timeframe of three years or more. These projections are all about your big-picture goals, like expansion plans or major investments. They help you strategize for the future and understand where you want your business to be in the coming years.

2. Scenario-Based Projections

Next, we have scenario-based projections. This method allows you to create different outcomes based on varying conditions. Here’s how it works:

- Best case: This is the dream scenario where everything goes right! You hit all your sales targets, and expenses are lower than expected. It’s good to see what could happen if things align perfectly.

- Worst case: Here, you plan for the worst possible situation. Maybe sales drop significantly, or unexpected costs pop up. This helps you prepare for potential setbacks and develop contingency plans.

- Most likely: This is your realistic projection based on what you believe will actually happen. It combines elements from the best and worst-case scenarios to give you a balanced view of what to expect.

3. Rolling Forecasts

Finally, let’s talk about rolling forecasts. This type of projection is super flexible! Instead of sticking to a fixed time frame, rolling forecasts continuously update as new data comes in. For example, if you start with a one-year forecast, every month, you would add another month to the end and drop the oldest month.

The advantages of rolling forecasts include:

- Agility: You can quickly adapt to market or business changes, allowing you to make timely decisions.

- Improved accuracy: Regular updates help keep your projections relevant and grounded.

Common Challenges in Financial Projections

Common Challenges in Financial Projections

Here are some of the common challenges you might face when making your projections and how to navigate them.

Uncertainty and Unpredictability of Markets

One of the biggest hurdles in financial projections is the uncertainty of markets. Let’s be real—things can change overnight! Whether it’s a sudden economic shift or unexpected trends, it can feel like you’re trying to predict the weather in a storm.

- The key here is to stay informed and keep an eye on market trends. Regularly reviewing your projections can help you adjust to new information and avoid surprises.

Impact of External Factors

External factors can also throw a wrench in your plans. This includes everything from economic downturns to changes in regulations. For example, a new law could affect your operating costs or customer demand.

- To combat this, consider building different scenarios into your projections. By having best-case and worst-case scenarios, you can prepare for a variety of outcomes and stay one step ahead.

Importance of Adaptability and Flexibility

Finally, the importance of adaptability and flexibility in your projections can’t be overstated. Rigid plans can lead to missed opportunities or, worse, financial trouble.

Make it a habit to regularly review and adjust your projections based on the latest data and trends. This way, you can pivot as needed and keep your business on the right track.

📌 Must Read: What is a business plan & why do we need it? 👈

Best Practices for Effective Financial Projections

Best Practices for Effective Financial Projections

Here are some best practices for ensuring your projections are on point, which can greatly improve their accuracy and effectiveness.

1. Incorporate Input from Various Departments

Don’t go at it alone! Getting input from different departments like sales, marketing, and finance is super important. Each team has its own insights and expertise that can enhance your projections. For example, the sales team might better understand customer trends, while finance can help with cost analysis.

2. Use Reliable Data Sources

Make sure you’re using reliable data sources when building your projections. This means checking your historical data, market research, and industry reports. Good data helps you make informed decisions and avoid any wild guesses. Remember, the more accurate your data, the more trustworthy your projections will be!

3. Regularly Review and Adjust Projections

Markets change, and so should your projections! It’s crucial to regularly review and adjust your financial projections based on new information and changing circumstances. Depending on your business needs, this might mean updating your numbers quarterly or even monthly. Keeping your projections fresh helps you stay agile and responsive to shifts in the market.

4. Communicate Clearly with Stakeholders

Finally, don’t underestimate the importance of clear communication with your stakeholders. Everyone should be on the same page regarding your projections, whether it’s investors, team members, or partners. Share insights, updates, and the rationale behind your numbers to build trust and confidence. This transparency can lead to better collaboration and support as you work towards your business goals.

Conclusion

Conclusion

In summary, financial projections are essential tools for any business, helping you navigate uncertainty and plan for the future. They play a crucial role in risk management, securing funding, and setting achievable goals. By implementing effective projection practices—like using reliable data, regularly updating your numbers, and being flexible with your assumptions—you can enhance your business strategy and boost your chances of success.

Role of Launchroad in The Seccess of Your Startup Visa

LaunchRoad is your trusted partner for starting a business abroad. We guide you in choosing the right country, understanding visa requirements, and getting your startup off the ground. As an experienced startup visa consultant, we offer expert startup visa consultation to help you navigate the complexities of international expansion. Our team provides the support, mentorship, and resources you need to succeed in the global market.

FAQ

How are financial projections calculated?

Financial projections are calculated using historical data, market analysis, and assumptions about future performance. The process typically involves estimating revenue based on sales forecasts, calculating expenses, and analyzing cash flow to ensure the business can meet its financial obligations.

Why are financial projections important?

Financial projections are crucial for business planning as they help entrepreneurs understand the potential financial impact of their decisions. They serve as a roadmap for achieving business goals, attract investors, and guide resource allocation.

What are financial projections used for?

Financial projections are used for several purposes, including:

- Securing funding: Investors and lenders often require projections to assess the viability of a business.

- Strategic planning: They help set realistic goals and identify potential challenges.

- Performance measurement: Businesses can compare actual results to projections to evaluate performance and make necessary adjustments.

What information is used to help prepare financial projections?

To prepare financial projections, businesses typically gather:

- Historical financial data (e.g., past sales, expenses)

- Market research (e.g., industry trends, customer behavior)

- Economic indicators (e.g., inflation rates, economic growth)

- Assumptions about future sales and costs.

What are the two types of financial projections?

The two main types of financial projections are:

- Short-term projections: Usually cover one year or less, focusing on immediate operational aspects, such as monthly cash flow.

- Long-term projections: Extend beyond one year, often encompassing three to five years, and focus on strategic growth and sustainability.

How do you write a financial projection?

To write a financial projection:

- Gather data: Collect historical financial data and market research.

- Identify assumptions: Outline key assumptions that will impact future performance.

- Create projections: Use spreadsheets or financial software to calculate revenue, expenses, and cash flow.

- Review and revise: Regularly update projections based on new data and changing market conditions.

What is included in financial projections?

Financial projections typically include:

- Revenue forecasts: Estimated sales over time.

- Expense estimates: Projected costs of operations, including fixed and variable expenses.

- Cash flow statements: Expected cash inflows and outflows to assess liquidity.

- Profit and loss statements: Projections of net income over the period.

What does financial projections mean?

Financial projections refer to the process of estimating future financial performance based on historical data, market conditions, and planned business activities. They provide a framework for anticipating revenue, expenses, and profitability.

How to do financial projections for a startup?

To do financial projections for a startup:

- Conduct market research: Understand your target market and competition.

- Estimate startup costs: Identify all costs associated with launching the business.

- Forecast revenue: Create realistic sales estimates based on market demand.

- Create a cash flow plan: Ensure you account for all cash inflows and outflows.

- Use financial software or templates: Simplify the calculation process and maintain accuracy.

How to do financial projections in Excel?

To create financial projections in Excel:

- Set up your spreadsheet: Start with separate tabs for revenue, expenses, cash flow, and profit and loss.

- Input historical data: Enter past financial data to use as a baseline for your projections.

- Create revenue forecasts: Use formulas to project future sales based on historical trends and market research.

- Estimate expenses: List all fixed and variable costs, then calculate future expenses using growth rates.

- Calculate cash flow: Create a cash flow statement that includes all cash inflows and outflows.

- Review and analyze: Use charts and graphs to visualize the projections and analyze trends.

How to do a 3-year financial projection?

To do a 3-year financial projection:

- Gather historical data: Collect data from the past 1-3 years to establish trends.

- Identify growth rates: Determine expected growth rates for revenue and expenses based on market conditions and business plans.

- Create annual projections: Estimate each year's revenue, expenses, and profit over the next three years.

- Develop a cash flow statement: Include anticipated cash inflows and outflows for each month or quarter.

- Regularly review and update: Adjust your projections accordingly as data becomes available.

How to make financial projections?

To make financial projections:

- Research your market: Understand industry trends and customer behavior.

- Establish assumptions: Determine assumptions for revenue growth, pricing, and cost increases.

- Use financial modeling: Create a model that incorporates your assumptions into a spreadsheet.

- Project revenues and expenses: Calculate expected income and costs over the projection period.

- Compile results: Create a summary of your projections, including profit and loss statements and cash flow forecasts.

What is a financial projection definition?

A financial projection is an estimate of future financial performance based on historical data, current market conditions, and planned business activities. It typically includes forecasts for revenue, expenses, profits, and cash flow over a specified period.

What is the main purpose of financial projections?

The main purpose of financial projections is to help businesses plan for the future by estimating their financial performance. They provide insights into potential profitability, aid in securing funding, guide strategic decision-making, and enable businesses to track progress toward their financial goals.

What financial projections are necessary for a business plan?

Essential financial projections for a business plan typically include:

- Revenue forecasts: Estimated sales for the next 1-3 years.

- Expense estimates: Projected costs of running the business.

- Profit and loss statements: To show expected profitability.

- Cash flow statements: To assess liquidity and cash management.

- Balance sheets: To outline assets, liabilities, and equity over time.

Why do we need financial projections?

Financial projections are needed to:

- Plan for growth: Help businesses understand the resources required for expansion.

- Secure financing: Attract investors or lenders by demonstrating potential profitability.

- Measure performance: Provide benchmarks for evaluating actual results against expectations.

- Mitigate risks: Identify potential financial challenges and develop strategies to address them.

Why is financial forecasting important?

Financial forecasting is important because it allows businesses to:

- Make informed decisions: Use data-driven insights to guide strategic planning.

- Prepare for uncertainties: Anticipate changes in the market and adjust accordingly.

- Track progress: Monitor performance against projections to identify areas for improvement.

- Secure funding: Present credible financial forecasts to investors and lenders.

What does a financial projection show?

A financial projection shows estimates of a company's future financial performance, including:

- Expected revenues: Anticipated income from sales.

- Projected expenses: Estimated costs associated with operations.

- Profitability: Expected net income after subtracting expenses from revenues.

- Cash flow: Inflows and outflows of cash, highlighting liquidity.

Will a financial crisis happen again?

While it's impossible to predict the future with certainty, financial crises can occur due to various factors, such as economic imbalances, market speculation, and external shocks. Monitoring economic indicators and maintaining sound financial practices can help mitigate risks and prepare for potential downturns.

What is a Financial Projection?

What is a Financial Projection? The Importance of Financial Projections

The Importance of Financial Projections Key Components of a Financial Projection

Key Components of a Financial Projection Steps to Create Financial Projections

Steps to Create Financial Projections Different Types of Financial Projections

Different Types of Financial Projections Common Challenges in Financial Projections

Common Challenges in Financial Projections Best Practices for Effective Financial Projections

Best Practices for Effective Financial Projections Conclusion

Conclusion

Leave a Reply